I Lived in a “Cashless Society” for a Month. It Was Terrifyingly Convenient.

It was a Tuesday morning at the Sanyuanli wet market in Beijing, a place that assaults your senses with the sharp tang of cilantro, the metallic scent of raw fish, and the warm, yeasty aroma of fried dough. I stood before a stall selling winter dates, clutching a crumpled 100-yuan note like a lifeline.

The vendor, a woman in her sixties with weathered hands, was expertly bagging the fruit. When I extended the red banknote, the air between us seemed to freeze. She didn’t take it. Instead, she looked up with an expression I hadn’t encountered back West—a mix of confusion and mild pity. It was as if I had handed her a pottery shard from the Ming Dynasty, or perhaps a dry leaf.

“No change,” she grumbled, gesturing with her chin toward a laminated QR code dangling precariously above a pile of dirt-caked potatoes. “Scan that. Hurry up, people are waiting.”

In that moment, I felt like a caveman who had just wandered into a server room.

For the past month, I decided to abandon my physical wallet entirely, surrendering my survival to my smartphone. In Silicon Valley, this would be a “tech detox” challenge or a beta test. In China, it’s just the default factory setting for 1.4 billion people.

Cognitive Dissonance on the Street Corner

The most jarring moment of cognitive dissonance hit me at a roadside food stall late one night. We’re talking about a sticky, folding table that reflected the neon streetlights in its grease. The cook, a shirtless man working a wok with violent precision, sent sparks flying into the humid night air. The setting felt gritty, almost vintage—until it was time to pay.

There was no fumbling for grimy coins. Just a quick beep, and the transaction was archived in the cloud. This Cyberpunk contrast—the raw, rudimentary street life seamlessly fused with invisible, frictionless data streams—is strangely harmonious here.

The Tax of Convenience: Battery Panic

But this convenience comes with a tax: a new, visceral form of anxiety. Battery Panic.

In London or New York, if my phone dies, I can’t scroll through Instagram. Annoying, but survivable. Here, a dead phone renders you a ghost. You become a non-entity. You cannot board the subway, you cannot buy a bottle of water, you cannot even unlock a shared bike to pedal home.

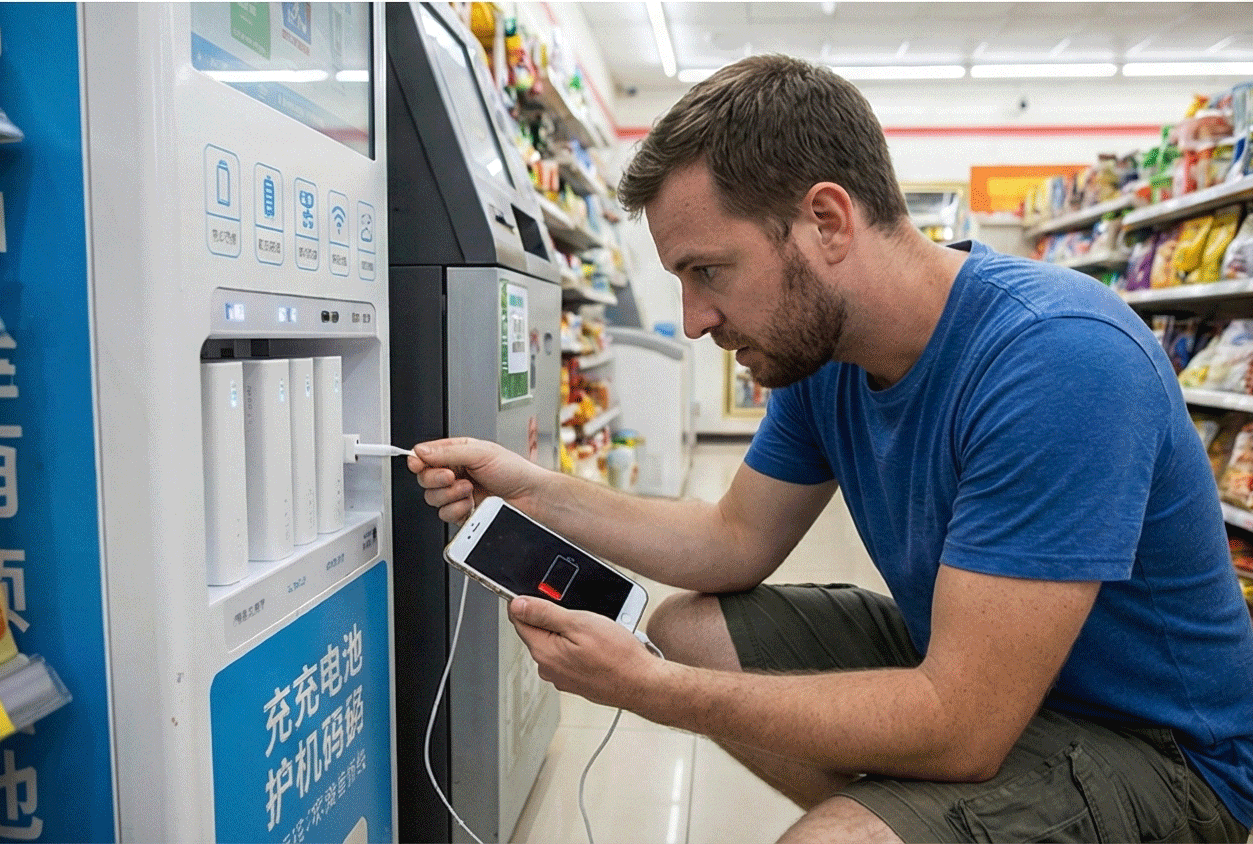

I remember standing at a busy intersection when my battery icon turned that menacing shade of red: 2%. The panic was physical, far sharper than the fear of losing a wallet. With seconds to spare before the screen went black, I dived into a convenience store and scanned a rental station for a portable battery pack. As the cable clicked in and the screen lit up, I audibly exhaled. It didn’t feel like I was charging a device; it felt like I was being put back on life support.

The Insight

The insight here isn’t just about technology; it’s about a cultural leapfrog. The West spent fifty years building a credit card system based on institutional trust. China skipped that chapter entirely, jumping straight to digital wallets woven into social apps. Paying a friend here is as intimate and casual as sending a text message. The skepticism we harbor in the West regarding big tech handling our money is outweighed here by the supreme deity of Convenience.

Yesterday, while cleaning out an old jacket, my fingers brushed against a cold, hard circle in the pocket. A one-yuan coin. I took it out and held it, feeling its weight, its ridges, its obsolete reality.

I admit, I kind of miss that heaviness. But to the sweet potato vendor down the street, it’s just a piece of metal dragging him down.

Leave a Reply